This year marks the ten-year-anniversary of starting my piano teaching business and I’m happy to say I’ve never been late on filing my taxes.

But that’s not to say that I was totally prepared for my first time filing with a Schedule C (the form business owners use to report income and expenses).

In fact, I ended up paying over a thousand dollars on my federal taxes!

Needless to say, I was a little overwhelmed by it all that first year.

So let’s talk taxes for piano teachers. Hopefully I can spare you some of the expensive surprises I encountered a decade ago.

And read on to learn about an inexpensive tool I use to save me hours of my time filing my taxes.

Do Piano Teachers Have to Pay Taxes?

Yes, piano teachers have to pay taxes on every penny they make teaching piano lessons.

But, what if I just taught the last couple of months of last year?

Yes, you still have to pay taxes on that income.

But, what if I only teach one or two students on the side of my nine to five job?

Yes, you still have to pay taxes on that income.

Large or small, the IRS requires every earned penny to be reported.

Disclaimer

Big ol’ disclaimer here…

I am not in any way a tax professional, IRS specialist, or licensed anything!

I am simply a piano teacher who has filed taxes for years with a professional.

And if you take away one piece of advice from this article, let it be this:

GET YOURSELF A TAX PROFESSIONAL TO HELP YOU.

With that out of the way, let’s go through a list of piano teacher tax deductions to make sure you’re recording all possible savings!

List of Piano Teacher Tax Deductions

I just have to mention, just because you see something on this list does not necessarily mean that you will qualify to claim it as a deduction.

My best advice is to record everything from month to month in its category, and then take that to a tax professional and they can let you know what applies for your situation.

Remember, it’s easier to keep track of an expense and then NOT claim it than to realize later you COULD’VE claimed it but you didn’t.

But without further ado, my list of possible piano teacher tax deductions.

We’ll start with the most obvious expenses, and work our way to the least obvious categories you might not have considered.

THE LIST of Piano Teacher Tax Deductions

- Piano Books

- Digital Downloads

- Keyboards, Pianos, or Accessories

- Office Supplies

- Stickers, Prizes, or Treats

- Event Costs

- Travel Costs

- Technology

- Space Rental or Home Office

- Education

- Memberships

- Contractors

- Repairs

- Advertising

- Subscription

- Fees

There it is! Now let’s flesh out each category briefly so you’re not missing any little expense this year.

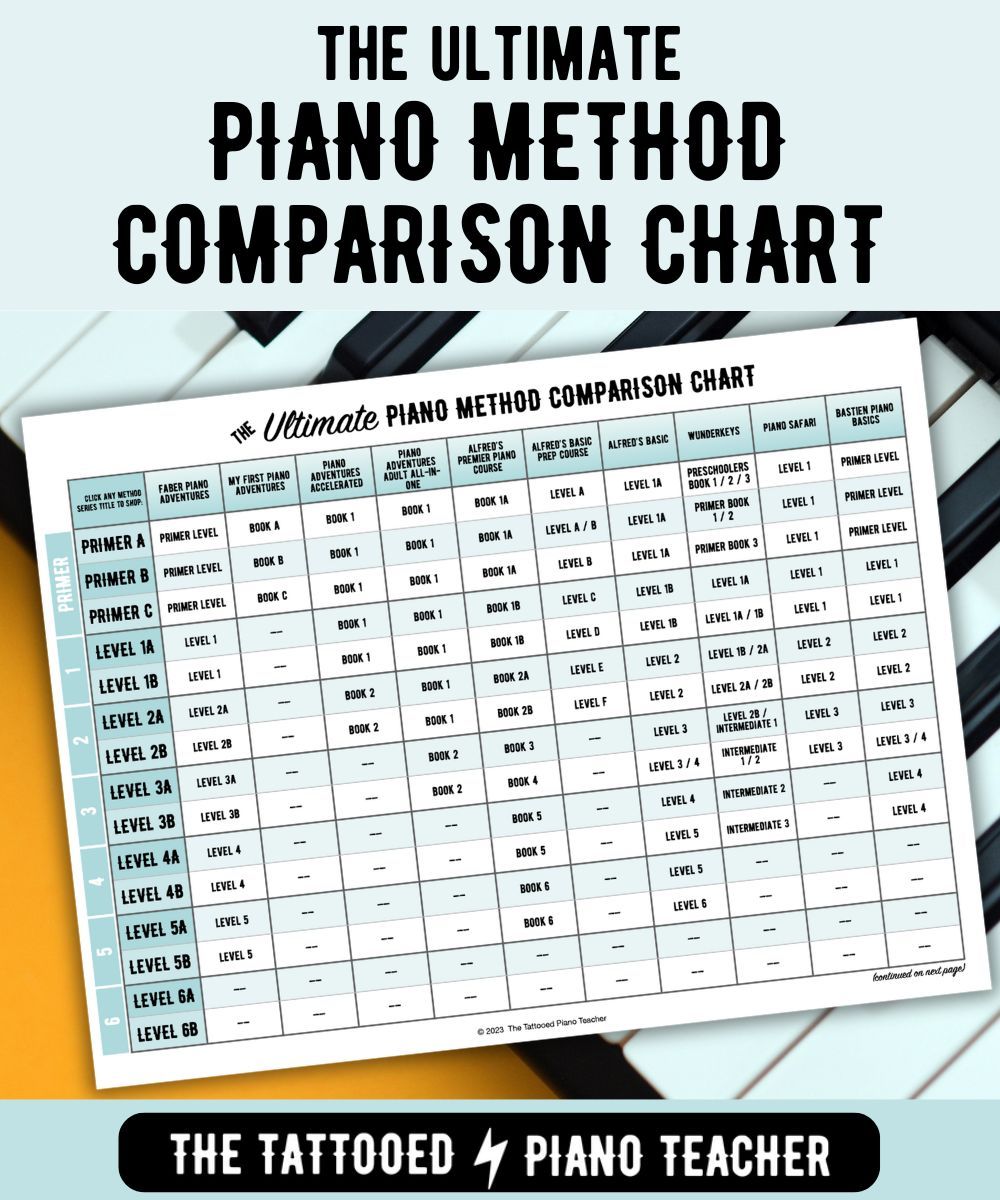

Piano Books: Piano Teacher Tax Deduction #1

Like I said, we’re starting with the obvious. Any method books, theory books, supplemental books, CDs, music downloads, games, activities, flash cards, or any other materials that you use in lessons should be recorded.

Digital Downloads: Piano Teacher Tax Deduction #2

Keep track of any sheet music or other digital downloads you use with students. I know these are only $4-5, but they add up over the course of the year!

Keyboards/Accessories: Piano Teacher Tax Deduction #3

Obviously any instruments you purchase for the studio should be recorded. Don’t forget to include any accessories such as a piano light, pedal, bench, headphones, or any other equipment for the studio.

Note that if you are purchasing a big ticket item, you may be claiming depreciation rather than a lump sum on your taxes. Definitely consult with a tax professional and check the IRS website for more details.

Office Supplies: Piano Teacher Tax Deduction #4

Keep track of everything from bookshelves or furniture used in your studio space to printer paper, highlighters, sticky notes, etc.

Stickers, Prizes, Treats: Piano Teacher Tax Deduction #5

You can also record any stickers you purchase to use with your students as well as prizes or treats used in the studio or at studio events.

Event Costs: Piano Teacher Tax Deduction #6

If you are renting a space for recitals, or spending money on decorations, food or other items needed to host the event, save all receipts and invoices for these expenses, too.

Travel Costs: Piano Teacher Tax Deduction #7

This is a tricky one, so definitely consult a tax professional and check out the IRS website regarding deducting travel expenses.

As a piano teacher, if you are traveling to students’ homes you may be able to deduct part of your mileage.

Or if you take a trip for a piano teacher workshop or other, you may be able to deduct part of the trip costs.

If you’re unsure, keep track of everything, and bring it all to your tax professional to sort out.

Technology: Piano Teacher Tax Deduction #8

Don’t miss out on this category, for sure! Record all purchases made for the studio including computer, tablet, paid apps, software, hardware, computer accessories, printer, camcorder, memory cards, or anything else purchased exclusively for studio use.

If you are making a big ticket purchase such as a desktop or laptop computer, depending on the amount spent, you may be claiming depreciation rather than a lump sum on your taxes. Consult with a tax professional and check the IRS website for more details on depreciation.

Space Rent/Home Office: Piano Teacher Tax Deduction #9

This is another category where the IRS has specific rules about how much can be claimed. I highly recommend reading up on the topic on their website as well as consulting a tax professional to get this all correct on your taxes!

If you rent a space or own a building for your studio, keep track of all expenses related to renting and maintaining the space.

And if you teach out of your home, you may qualify for home office deductions on your mortgage, rent, and/or utilities, but there are rules regarding what is considered a home office. At the risk of sounding like a broken record, consult a tax professional!

Education: Piano Teacher Tax Deduction #10

Did you further your education this year by attending workshops, taking classes, or taking private lessons yourself? Record those expenses, too. Even books or online courses that help you become a better piano teacher can apply.

Memberships: Piano Teacher Tax Deduction #11

Do not miss this one! If you are a member of any local musician organizations and pay annual dues, include that as an expense.

And if you pay a monthly membership fee to any services, mentorships, catalogs, magazines, or the like for your personal growth as a teacher or for the studio, that may count as well.

Keep track of it all and consult with that handy dandy tax pro!

Contractors: Piano Teacher Tax Deduction #12

If you do hire someone to help you with your studio duties, keep track of everything you pay them as well. This could be another piano teacher who teaches for your studio, or a VA or in-person administrative assistant.

Be sure to also read up on the IRS’ policies regarding issuing a 1099-NEC to any paid contractors. A tax professional can help you sort this out as well.

Repairs: Piano Teacher Tax Deduction #13

If you have an acoustic piano, keep track of any piano tuner visits or repairs made to your instruments. This also applies if you have a digital piano or keyboard repair. Or any maintenance or repair costs related to a part of your studio or its equipment.

Advertising: Piano Teacher Tax Deduction #14

Any money spent on advertising of any kind should be recorded. This could be paid online ads, or even physical mailings or flyers.

Also include all website and domain fees as well as this is a part of advertising your business.

Subscriptions: Piano Teacher Tax Deduction #15

These little subscriptions can slip through the cracks, so make you’re recording all studio related subscriptions.

Perhaps you pay a monthly subscription fee to an online scheduling or invoicing platform like MyMusicStaff. Or if you use a payment processing system that charges a monthly fee.

If there are services you use in your studio related to music and you pay a monthly fee, make sure to record those as well.

In the next section, I’ll go over how to easily record these monthly expenses once as a recurring expense to make life easier.

Fees: Piano Teacher Tax Deduction #16

And, finally, don’t forget about any extra fees not covered in the other categories.

The biggest one for me is bank fees and credit card fees that get added on when customers pay me online.

These add up quickly so make sure you’re keeping track of them from month to month.

In the next section, I’ll show you how automatic recording fees can be.

Organizing for Tax Time

If it’s not clear by now, you need a SYSTEM for keeping track of all income and expenses throughout the year.

Do not, I repeat, DO NOT go to your tax professional with a shoebox full of receipts like it’s 1991. Not when it’s this easy and this inexpensive to keep it all in one place so seamlessly.

My piano teacher friend, let me introduce you to MyMusicStaff. And, no, I am not sponsored by the platform. I have just literally used it for nine years and could not imagine running my business without it!

MyMusicStaff makes life easier when it comes to taxes for piano teachers with these features:

- Automatically records any credit card or bank fees when customers pay

- Automatically records income from all customers and categorizes it for you

- Automatically records recurring monthly expenses (set it up once and forget it)

- Automatically records payroll totals if you have other teachers to may payroll day so easy

- Streamlines the recording of other expenses (set up tax categories once and make daily entering of expenses literally a 30-second task)

- Streamlines tax time with one-click income and expense reports all beautifully organized and ready to submit to your tax professional

And this is not even getting into all of the other non-tax features such as music studio specific design, easy scheduling, parent portal, auto invoicing, and much more.

MyMusicStaff is $14.95 for a single–teacher studio account and you get to try it free for 30 days.

So definitely give it a try for 30 days and thank me later!

This is an affiliate link and I may get a free month of MyMusicStaff if you sign up for a paid plan. And I thank you!

I also have a full review of MyMusicStaff if you want to learn more.

Estimated Taxes for Piano Teachers

What is estimated taxes? Estimated taxes are tax payments made throughout the year.

You know how employers take a little bit out of each paycheck for federal and state taxes? As a business owner, you have to take out a little bit of money from your earnings each quarter.

The consequences of not paying estimated taxes throughout the year are: you could have to pay a large lump sum at tax time and you could also have to pay an additional penalty for not making your quarterly tax payments.

So if this is all new to you, I recommend finding a tax professional right away (like, way before tax time). They can help you sort out the IRS policies on paying estimated taxes and can help you calculate how much you should be paying each quarter, where to send it, and even send you reminders each quarter.

If you have no idea where to look for a tax professional who specializes in small business owners, I have used H&R Block for 20 years and have had a great experience. I would love to have you use my affiliate link if you want to find an H&R Block tax pro in your area.

Taxes for Piano Teachers 101

Okay, that was a ton of information and not by any means a complete guide to taxes for piano teachers.

So let’s break it down to the bare bones if you are just getting started as a piano teacher.

If I were starting all over again, here’s what I would do in my first year of teaching…

- Start using MyMusicStaff right away

- Record every single penny spent in the Schedule C category I think I should go in (tax pro can sort out later)

- Save all receipts digitally (they can be uploaded to MyMusicStaff)

- Find a tax professional before tax time. Ask about estimated tax payments.

- At tax time, use MyMusicStaff to print an income report and an expense report.

- Submit those reports to the tax pro early so they can look them over.

Voila! Stress-free taxes.

Really, the take aways here are:

- Find yourself a tax professional sooner rather than later.

- Implement a good system of keeping track of every penny EARNED and every penny SPENT right away.

Need More Help With Taxes for Piano Teachers?

I’m no professional and everything I’ve learned has been from my dear tax professional at H&R Block as well as my own research.

So definitely reach out to someone who really knows the ins and outs of filing taxes as a small business owner!

I’m not sponsored or affiliated with H&R Block in any way. I’ve just used them for two decades and have had a good experience personally.

Find an H&R Block tax professional in your area.

Try MyMusicStaff

I really can’t say enough good things about MyMusicStaff for keeping yourself organized. I know there are other ways of keeping track of income and expenses out there. But I’m quite sure there are none as affordable and specialized as MyMusicStaff.

For more information, you might want to check out these blog posts:

And with their 30-day (no credit card required) risk-free trial, you really can’t go wrong.